Remember when ICBC, Dave Eby and the NDP government launched a multi million dollar marketing campaign promising British Columbians they are bringing ‘enhanced care’ to ICBC and how much more crash victims will be getting?

Well, turns out that was none of it was true.

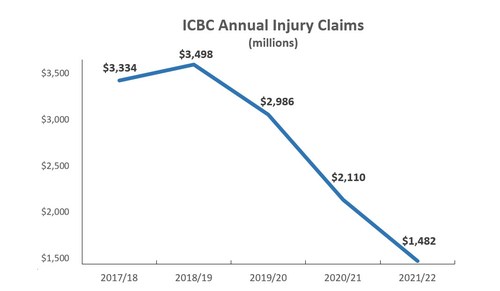

Crash victims are getting less under no-fault. A lot less. Data is out showing ICBC is paying crash victims 30% less than prior to ‘enhanced care’ despite there being more crash victims than ever!

But ICBC getting more. They are paying themselves more than actual crash victims! Paying yourself more to give crash victims less. Quite the monopoly.

Data was published this week by the Insurance Bureau of Canada shedding a light on the truth of what no fault is. I republish it below. It speaks for itself:

VANCOUVER, BC, Nov. 3, 2022 /CNW/ – New data from the first year of the Insurance Corporation of British Columbia (ICBC) “Enhanced Care” no-fault regime shows that the Crown insurer’s operating expenses exceeded what it provided in injury claims by $173 million in 2021/22.

According to its 2021/22 year-end financials, the switch to a pure no-fault system has allowed ICBC to reduce what it provides to accident victims by 30%. This, despite the fact that collisions were up significantly over that same time period.

In 2020/21, the year before no-fault came into effect, ICBC paid out $2.11 billion in injury claims to help individuals recover. In 2021/22, under the first year of no-fault, claims paid fell to $1.48 billion. In contrast, last year ICBC spent $1.62 billion in operating costs.

“The purpose of auto insurance is to ensure that people get the benefits they need to recover from injuries sustained in an accident,” said Aaron Sutherland, Vice-President, Pacific and Western, Insurance Bureau of Canada (IBC). “ICBC’s dramatic reduction in claims costs calls that key tenet of insurance into question. Rather than focusing on improving its own internal operations to find efficiencies and savings for drivers, it’s appears that ICBC is balancing its books by reducing what it provides to those injured in collisions.”

Over the past year, there has been a constant stream of media coverage detailing the plight of those injured in auto accidents in BC. It’s clear that those who are seriously injured deserve legal recourse if they are not receiving the benefits they need to recover. It also strengthens the argument that drivers deserve a choice and the ability to shop around to find the auto insurance policy that is best for them.

“This reduction in care and recovery benefits illustrates the painful truth about ICBC’s no-fault model, and those injured are suffering the consequences,” said Sutherland. “Now, more than ever, drivers need a choice to ensure they are receiving the best insurance at the best price possible.”

Over the coming weeks, IBC will continue to highlight the uncomfortable truth about ICBC and its new no-fault model. ICBC’s own data clearly shows that the monopoly insurer has focused on reducing the amount it pays in benefits to help drivers recover, while ignoring its own internal problems and passing undue costs on to British Columbians.