When Chinese Leading Li Keqiang known as for a “sense of urgency” about developing economic threats all through a meeting with provincial officers previously this 7 days, it was his 3rd this kind of warning in days.

“We need to be very vigilant for unforeseen adjustments in the international and domestic conditions, and downward economic stress has even more mounted,” China’s No 2 official informed a symposium in Jiangxi province on Monday, according to a report in South China Morning Article, considerably less than a 7 days just after drawing notice to the “complicated and evolving” world wide problem and COVID-19 outbreaks at home.

As China’s draconian “dynamic zero-COVID” pandemic limits and uncertainties which includes the war in Ukraine weigh on progress, Beijing appears ever more anxious about the potential clients for the world’s 2nd-greatest overall economy.

The unsure outlook casts question on the ruling Chinese Communist Party’s means to reach its goal of 5.5 percent financial growth in 2022, even as point out media insist the formidable intention continues to be within just attain, introducing to mounting risks for the global financial system that include war in Europe, soaring electrical power costs and approaching fascination charge boosts in the United States.

And it raises questions about how far policymakers may perhaps go – irrespective of adverse economic consequences – to fulfill Beijing’s lofty ambitions.

If COVID-19 are unable to be immediately brought less than management – which looks significantly not likely – then either Beijing’s zero-tolerance pandemic strategy or the expansion focus on will have to go, said Carsten Holz, an skilled on the Chinese overall economy and professor at the Hong Kong University of Science and Know-how (HKUST).

“In the experience of lockdowns, the previous channel from state-directed credit to state-directed investment decision or creation becomes inoperative,” Holz informed Al Jazeera. “A rather lockdown-free rural sector simply cannot preserve the real GDP growth amount: Agriculture’s share of GDP is only 8 per cent.

“Industry, the most significant sector in GDP, are not able to, possibly, as extensive as there are lockdowns, nor can the journey and hospitality industries,” Holz claimed.

Amongst China’s prime 100 towns by GDP, all but 13 are beneath some stage of pandemic limitations, with the depth of these controls on the increase, according to a modern examination by global investment research organization Gavekal.

In Shanghai, a stringent lockdown has forced suppliers these kinds of as Tesla and fellow carmaker Nio to suspend generation and delay shipments at the city’s port, the greatest of its sort worldwide, although sparking uncommon shows of civil unrest amongst the metropolis’s 26 million people.

In March, China’s factories noticed activity drop at the fastest tempo in two decades, while vehicle income fell practically 12 p.c year on calendar year.

‘Life previously mentioned all’

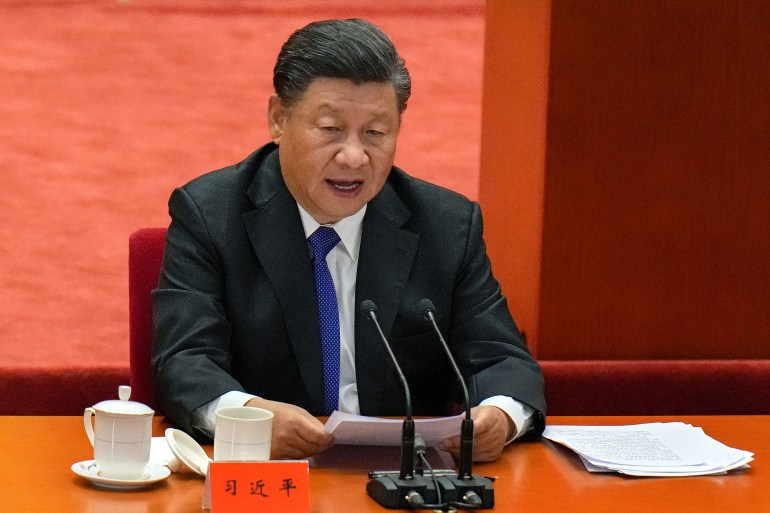

Even with the mounting charges, Chinese President Xi Jinping, who is bidding to safe an unprecedented third time period at the following get together congress in Oct, has continuously dominated out any shift away from dynamic zero-COVID, insisting this week the place must “persist putting folks earlier mentioned all, daily life higher than all.”

Dealing with deteriorating financial prospects, Beijing has flagged accelerating the rollout of professional-expansion actions these types of as tax cuts and rebates and profits of exclusive-intent bonds (SPBs) to fund infrastructure initiatives.

On Monday, the China Securities Regulatory Fee declared that it would request extended-term investors and key shareholders to obtain up shares to support stabilise the country’s sagging stock industry, which in March saw overseas outflows of $11.2bn in bonds and $6.3bn in stocks.

Many analysts be expecting a lot more sweeping actions, which includes curiosity amount cuts and looser lending procedures, to stick to in the in close proximity to potential.

“Up right up until now, Chinese leaders have been exceptionally careful about stimulus, but if issues carry on the way they are going, Beijing may have small selection but to return to the infrastructure stimulus playbook to goose development,” Joe Mazur, a politics and finance analyst at Trivium China, advised Al Jazeera.

Taylor Loeb, a finance and politics analyst also at Trivium China, reported financial conditions have achieved the position the place “support guidelines are heading to have to forged a wider net”.

“That signifies cuts to banks’ reserve prerequisite ratios (RRRs), a measure that provides the financial sector more agency in who they lend to,” Loeb informed Al Jazeera.

“We’re also viewing a quickened rollout of the SPBs that commonly fund regional govt infrastructure jobs. SPB cash, like RRR cuts, run the danger of ending up in unproductive projects – as took place throughout the 2010s – but that may well be a chance central policymakers have to consider to juice the financial state.”

Holz, the HKUST professor, proposed Beijing could maybe entertain drastic measures to attain its target, these as doubling the salaries of state and Communist Social gathering personnel.

“It would create a spending budget deficit on the get of, roughly, 20 p.c, but that would not turn into thoroughly apparent until finally right after the 20th Nationwide Congress of the Chinese Communist Social gathering,” he said.

Even so, many economists are sceptical that nearly anything in Beijing’s toolkit will be ample to avert a considerable slowdown in advancement.

On Friday, Morgan Stanley slashed its progress forecast for the Chinese economic climate this year to 4.6 percent, down from 5.1 p.c.

“The policy stimulus will not be that successful as extended as mobility is limited on a broad scale,” Tommy Wu, guide economist at Oxford Economics in Hong Kong, instructed Al Jazeera.

“The authorities will have to minimize their emphasis on their progress target and be realistic about how the domestic headwinds and a challenging external setting will affect China’s financial state by way of this 12 months.”

If China’s opaque leadership simply cannot tummy changing its financial ambitions, particularly in a politically delicate year, it could seek to transform the narrative as an alternative.

“Party Secretary Xi Jinping’s likeliest calculation will be that the least difficult alternative to the conundrum is to blame COVID-19 for not becoming equipped to attain the growth concentrate on, maintain the demise amount lower with the assistance of intensive lockdowns, and secure his tenure as social gathering secretary at the 20th social gathering congress. The PRC’s genuine growth amount in 2022 could be anything at all, per cent or even negative,” Holz said.

“And need to general public discontent with lockdowns access unparalleled dimensions, he could cite new scientific proof and let the COVID wave roll as extended as he can existing himself as the rational, properly-which means leader that deserves yet another time period as party secretary and president.”